IMPACT Supports Partner Banks in Expanding Access to Finance for Drug Shops and Pharmacies

The United States Agency for International Development (USAID), aware of the importance that the private health sector plays in the accessibility of medicine in Madagascar, has established partnerships with financial institutions that agreed to work with private health providers, pharmaceutical enterprises, and water and sanitation hygiene (WASH) companies. USAID signed a guarantee agreement with AccèsBanque Madagascar in September 2015, and another with Baobab Banque in September 2017, to help improve access to finance for the private health sector. Through these agreements, the USAID Development Credit Authority, now the U.S. International Development Finance Corporation (DFC), promised to reimburse the banks up to 50 percent of any losses on qualifying loans placed under the guaranteed agreement. In addition, since 2019, the USAID-funded Improving Market Partnerships and Access to Commodities Together (IMPACT) program has provided technical assistance to these two banks, to help them serve private health commodities enterprises such as drug shops, pharmacies, and pharmaceutical wholesalers.

These loan guarantees, along with the technical assistance provided with USAID support, have clearly encouraged the partner banks to expand their lending to the private health sector in Madagascar. More importantly, this support has given the banks confidence to lend more to the health sector without using the guarantee, as the banks are not required to place loans under guarantee. They can choose which loans to place under guaranteed coverage based on the potential risk for each customer or loan and on the collateral offered by that client. The banks’ increasing willingness to lend without the external guarantee is a good sign that their expanded lending to the private health sector is sustainable in the long term.

Over the course of their partnership with USAID, the banks have learned that the risk of default in the health sector is low compared to other sectors, even during the economic recession following the COVID-19 pandemic.

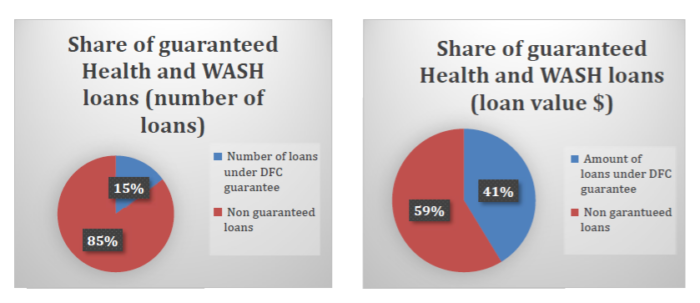

Since the launch of these partnerships, the banks have granted 631 loans totaling over $5.3 million to private health providers, health commodities enterprises, and WASH enterprises. Eighty of these loans, valued at almost $1.5 million, have been placed under the DFC guarantees, with a current utilization rate of guarantees at 36 percent. Seven of the guaranteed loans, a total of $195,856, were made to the WASH sector, with the remainder of the guaranteed loans going to private health entities. Only one guarantee claim has been filed to date, indicating that the banks’ private health and WASH sector loan portfolios are very strong, with minimal repayment problems.

Drug shops and pharmacies receiving loans from AccèsBanque and Baobab may use the funds to invest in their store infrastructure or to expand their inventory of high-quality medicine. This means that the people of Madagascar have better access to the health commodities they need.