Improving Private Health Sector Lending in Nigeria

Published April 2017 by USAID/West Africa Regional Health Office ParlerHealth Newsletter

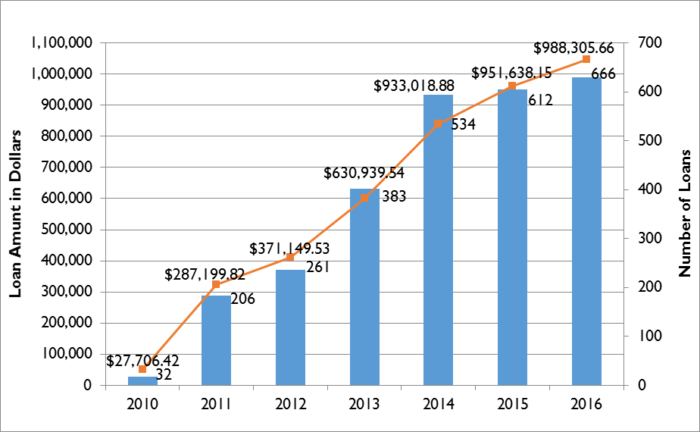

ACCION lending by amount (dollars) and number of loans

In 2009, a survey was carried out to assess the business development needs, particularly financial and training needs, of private health care providers in Nigeria. At that time, only 10 to 15 percent of private providers had applied for financing from a financial institution in the previous three years, though 40 percent indicated an interest in obtaining financing in the coming year. The study concluded that, “greater access to finance…is needed for the private sector to grow and improve its quality of care. That the private sector is large and has not accessed much financing represents a market opportunity for Nigeria’s financial institutions.

Accion Microfinance Bank (ACCION) officially began its microfinance banking business in May 2007. Prior to partnering with SHOPS in 2010, the bank offered a variety of financial products to micro-entrepreneurs. At the time, the bank had a poor understanding of the health sector. Consequently, a Development Credit Authority (DCA) loan guarantee with a limit of $400,000 was introduced in September, 2010 by USAID/SHOPS to ACCION to reduce the risk associated with lending to health businesses. This guarantee was intended to stimulate financing by ACCION to health care enterprises and thereby promote the delivery of quality family planning, reproductive health, and maternal and child health services.

In order to support the success of the DCA, the SHOPS project provided ACCION with technical assistance, including training of loan officers and sharing private health sector market research and information. The goal of this technical assistance was to help the bank better understand the private health sector, and ultimately to provide high quality financial products and services to this sector. According to Nwanna Joel, the Chief Commercial Officer of ACCION, “with the Financing the Nigeria Health Sector trainings received by our loan officers and the DCA agreement, the bank has a better understanding of the health provider, the risk associated with lending to them and had improved capacity to lend to the private health practitioners.”

The guarantee was to run through 2015, but demand for health loans was greater than expected, and the limit was reached within the first two years. Over the course of this relationship, ACCION’s understanding of the private health sector improved, and the bank saw how private health providers comprised a promising new market for its lending products. Despite full exhaustion of the guarantee in May, 2012, the bank’s lending to the sector has continued to increase, as depicted above. Over the life of the project (until end of December 2016), ACCION issued 2,694 loans to private health providers of which 328 (12.2%) were issued under the DCA guarantee. The total amount of loans reached over $4 million, leveraging the initial credit guarantee more than four-fold. The average loan amount was about $1,500 and the performance of the loans has been excellent, with no defaults under the guarantee. ACCION continues to increase its loans to private health providers and has incorporated loan officer training into its internal capacity development program.

This DCA guarantee was extended to Diamond Bank and has had an effect on the local landscape for lending to private health providers. In February 2013, the SHOPS project established a relationship with Fidelity Bank focused on optimizing and strengthening its lending products aimed at private providers. In subsequent years, several banks, including First Bank, Sterling Bank and Olive Microfinance Bank, approached the SHOPS project with requests for assistance in expanding their exposure to the private health provider market. Diamond Bank has recently launched a second product aimed at the private health sector, again indicating a desire to build on its own experience with the DCA to expand its involvement with this market. Read more here.